Whether you're exploring payday loan options, installment loans, or state-based availability, this page breaks down every step—so you can make an informed decision without confusion.

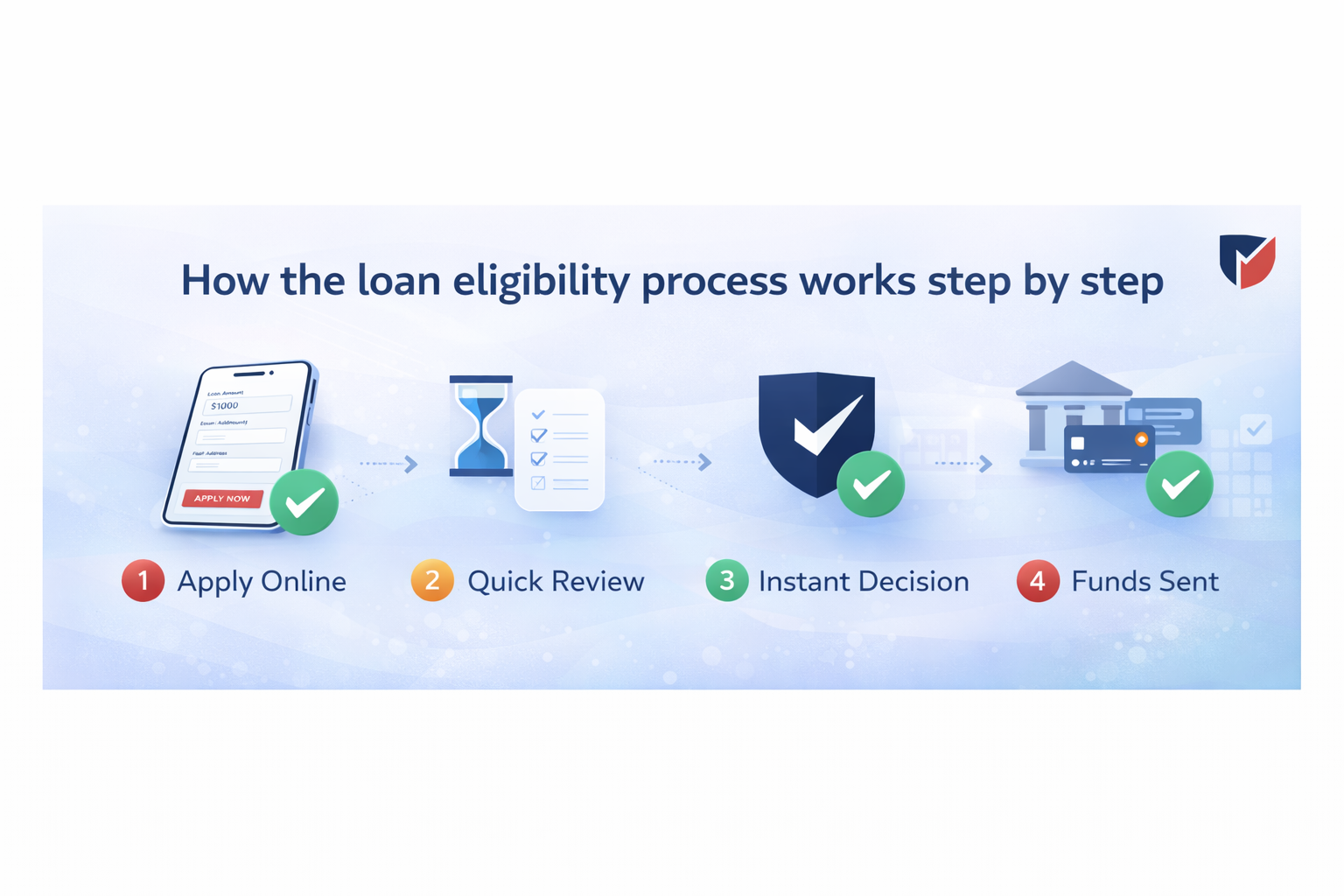

A simple walkthrough of the process—from starting to reviewing your options.

You begin with ZIP + state because rules vary across the U.S. This helps ensure the disclosures, availability notes, and option types are aligned with your location.

Explore availability first: States Hub.

Next, you review the differences between payday loan options and installment loans. Payday loans are typically short-term while installment loans may offer scheduled payments over time.

Compare here: Payday vs Installment.

If you continue, you move into a secure flow designed for verification and matching where available. Final approval and terms depend on lender review and state-based availability.

Start now: Apply Now.

Instead of hype, the goal is transparency. We explain the steps, highlight what’s state-dependent, and direct users to educational resources before they apply.

Some states permit payday loans, others restrict them heavily, and some prohibit traditional payday lending. That affects loan structure, fees, maximum amounts, and required disclosures. To explore your state, visit the States Hub.

Installment loans can offer repayment schedules that are easier to plan around. If predictability matters, installment structures may be worth reviewing. You can compare both options here: Payday vs Installment.

Quick answers about eligibility, disclosures, and state-based availability.

No. Eligibility checks may match you with potential options, but final approval depends on lender review, verification, and state availability.

Many eligibility checks are designed to be informational, but lender processes vary. Review disclosures before proceeding.

You typically start with ZIP + state. Additional information may be required later for verification depending on lender requirements.

No. Payday loan rules vary by location. Use the States Hub to explore your state.

Start securely. Review disclosures before continuing. Availability and terms vary by state and provider.